The biggest news to come out of Africa this year was the African Continental Free Trade Area (AfCFTA) launched on January 1. Currently, Africa accounts for just 2% of global trade (source: UNCTAD) and only 17% of African exports are intra-continental, compared with 59% for Asia and 68% for Europe. The pact creates the largest free trade area in the world measured by the number of countries participating. Connecting 1.3 billion people across 55 countries with a combined gross domestic product (GDP) valued at $3.4 trillion, according to WeForum.

The agreement aims to reduce all trade costs and enable Africa to integrate further into global supply chains – it will eliminate 90% of tariffs, focus on outstanding nontariff barriers, and create a single market with free movement of goods and services. Cutting red tape and simplifying customs procedures will in turn bring significant income gains. Beyond trade, the pact addresses the movement of persons and labour, competition, investment and intellectual property.

According to a report by the World Bank, the pact will boost regional income by 7% or $450bn, speed up wage growth for women, and lift 30 million people out of extreme poverty by 2035. Wages for both skilled and unskilled workers will also be boosted by 10.3% for unskilled workers, and 9.8% for skilled workers.

However, among this glimmer of hope we cannot forget the political instability Africa has, the protracted conflicts in Somalia, South Sudan, Sudan, Libya and the Central African Republic (CAR) remain on the agenda of the African Union (AU) Peace and Security Council (PSC). Tensions sharply rose with attempted armed marches on Bangui before the CAR’s December presidential and legislative elections. The opposition is contesting the poll results while armed groups continue to threaten peace and stability.

According to ISS (Institute for Security Studies) more attention must be paid to the conflicts in northern Cameroon and northern Mozambique. Gruesome killings during 2020 in both countries are a stark reminder that Africa needs to act quickly and decisively on early warnings of violence.

Ethiopia’s fragility has come to the fore with the outbreak of an armed conflict in November 2020 between federal government forces and the Tigray People’s Liberation Front. Further conflict could undermine stability both in Ethiopia and the entire Horn of Africa region. General elections were postponed from August 2020 to June 2021.

In the Sahel and West Africa, democratic governance deficits have contributed to political tensions and instability, and enabled terrorism. Several ad hoc measures have been taken, but the dynamic nature of the underlying causes continue to present major challenges.

In April this year, French energy giant Total said it was suspending work on a $20bn gas project in northern Mozambique following the latest jihadist assault on a nearby town.

“Considering the evolution of the security situation… Total confirms the withdrawal of all Mozambique LNG [Liquefied Natural Gas] project personnel from the Afungi site,” the company said in a statement.

Total added it was declaring a “force majeure” situation beyond its control, a legal concept meaning it can suspend fulfilling contractual obligations. In March there was a jihadist raid on Palma in Mozambique’s northern Cabo Delgado province which prompted Total to remove remaining staff from the natural gas site. It had already evacuated some workers and suspended construction in January following a series of jihadist attacks nearby.

The LNG project includes development of the Golfinho and Atum offshore natural gas fields and the construction of a two-train liquefaction plant.

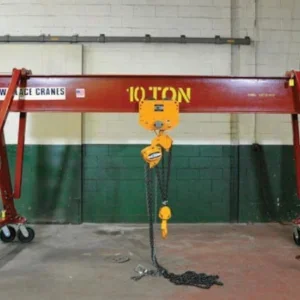

Marc Kleiner is the managing director, of Condra, based in Johannesburg, which began manufacturing its first overhead cranes in 1971 after seeing an opportunity for hoists and overhead cranes in the South African market in place of local assembly from imported components.

“Africa’s sporadic insurgencies are a problem. They make things difficult. Witness the recent attack by ISIS in Palma, northern Mozambique. One of the oil companies there declared force majeure because of that attack, so now we have the crane that they ordered stored here at our factory until the situation can be sorted out,” he says.

“In terms of the future, it will continue to remain possible to succeed in the African lifting equipment market, though it will remain difficult. But Condra is African and understands Africa. Therefore, our success is likely to continue.”

Indeed, it is not all doom and gloom, in March, the UK signed a trade partnership agreement with Ghana that secures tariff-free trade and provides a platform for greater economic and cultural cooperation.

The deal supports a trading relationship worth £1.2bn and reinstates the terms of the economic partnership agreement between the two sides when the UK was part of the European Union.

It means Ghanaian products including bananas, tinned tuna and cocoa will benefit from tariff-free access to the United Kingdom. UK exports are also in line to benefit from tariff liberalisation from 2023, including machinery, electronics and chemical products.

“With tariff-free access for Ghana to the UK, it will enable businesses to scale up their operations, support innovation in markets and create jobs as we recover together from the coronavirus pandemic,” said James Duddridge, UK Minister for Africa at the Foreign, Commonwealth and Development Office (FCDO).

“Ghana’s largest exports to the UK include mineral fuels and oil, preparations of fish, fruit, cocoa and cocoa preparations. Its top imports include clothing/textiles, machinery and mechanical appliances, and chemical products from the UK. The deal means the UK has now secured trade agreements with 65 non-EU countries, representing trade worth £217bn in 2019. This accounts for 97% of the value of trade with non-EU countries that we set out to secure agreements with at the start of the trade continuity programme.”

Total UK trade with Ghana was £1.2bn in 2019, of which UK exports were £652m. The UK government has secured trade agreements with 65 countries plus the EU. Total trade with these countries was worth £890bn in 2019. This is equivalent to 63% of UK total trade (Sources: ONS UK Trade).

Another success story is EnerMech, which has operated in Africa for more than ten years, working across the continent from Egypt to South Africa and Angola to Madagascar, providing mechanical, electrical, instrumentation and integrity services to the international energy and infrastructure sectors.

It recently established a presence in Mozambique hiring country manager Celestino Maússe and opening an office in the capital city of Maputo, the gateway to Mozambique’s international energy market.

“EnerMech has already established many successful partnerships across Africa and there is a lot of new activity in Mozambique. I am confident the company’s expertise and track record in local content development will help us develop a sustainable business, building a solid pipeline of new work across the local energy sector,” says Maússe.

The company has secured its first contract providing subsea pre-commissioning services on the Coral South Floating Liquified Natural Gas (FLNG) development. Located in Area 4 of the Rovuma Basin, Coral South is Africa’s first FLNG project and it will be the world’s first ultra-deep-water FLNG facility to operate at water depth of 2,000m.

“The award is highly significant for EnerMech as we look to support the development of the world’s first ultradeep- water FLNG facility, one of several large developments planned offshore Mozambique,” says Ross McHardy, regional director, Europe and Africa, EnerMech.

“Mozambique is fortunate to hold vast natural resources and minerals and with the pace of oil and gas activity in the country, we were eager to engage with and develop the local energy supply chain. With emerging opportunities within large infrastructure projects, we have identified the country as core to our future growth in the continent.”

According to Condra’s Kleiner, the African market is going to continue to evolve through cyclical demand for commodities, especially minerals and especially from China. That said, Africa’s challenge is going to be to resist the temptation to nationalise mining interests, which is counterproductive to meeting that demand.

“I would like to see easier access to some of the newer mines, which are often remote. The infrastructure in some places is not good. An example is an enquiry recently received from a mine in Cameroon, where access for the abnormal-load vehicles usually used to transport the crane girders is inadequate. These vehicles cannot navigate the existing road. So, the only way to deliver that crane will be to design everything for containerisation, including girders of almost 30 metres. The girders will have to be spliced and bolted together on site,” he adds.

The company has just started manufacturing eight coil-handling cranes for a new South African vehicle plant. Further afield, it is manufacturing a 60-ton overhead crane and a portal crane for Botswana, both to be delivered towards the end of this year. It is also supplying a crane to Bulyanhulu gold mine in Tanzania, where it supplied many of the initial cranes needed at the time of mine development.

“Africa could do better by realising that it is Africa and not Europe. By this I mean that some of the electronic refinements demanded by the customer are not well suited to the power outages and fluctuations that are typically African. That said, we continue of course to give the customer what he wants, while engineering it to be as immune to these problems as possible,” says Kleiner.

“Some years back we experimented with undercutting, but we have realised that we don’t want to compete against cheap products. We invest far too much in the Condra product to try to undercut. Our success bears out the fact that if a customer knows what he wants and has experience of other manufacturers, he will come to Condra. Many don’t only come to Condra once. They come back as repeat customers, and this has gradually given us more of the world market as well as the African market. Our growth into Canada and Australia has been largely based on people who have previously experienced the robust reliability of our products and insisted on Condra.”

Another of its recent projects is deliveries of customised cranes for injection-moulding and shipboard maintenance applications with a third overhead machine of unusual design, sporting an exceptionally wide span of no less than 35 metres.

A span of this magnitude is more than double the average of 15 metres and approaches the manufacturer’s record of 42 metres.

Not only is Condra’s newly completed crane unusually wide, but it is also large from an overall perspective, with box girders the height of an average man, and a 20 ton two-speed hoist mounted on a 7 metre-wide crab with a wheel base of six metres. A working platform of open-grid walkway and solid-forge handrail runs the full length of the machine.

The crane will be delivered to a platinum concentrator for maintenance duty. Weighing in at 33,3 tons, it has a lifting height of 18,7 metres and is controlled remotely by radio. There is a pendant back up.

During the crane’s design phase, the very large size of the machine dictated careful consideration of wind loading. Condra’s engineers included the company’s patented storm brake to counter wind forces anticipated at the installation site.

The storm brake is activated by anemometers in two stages, the first sounding a siren when the wind speed reaches 30 km/h, and the second automatically engaging the brake at a wind speed of 50 km/h. At this point, any crane operation is de-activated and the machine automatically secured against all movement.

Condra completed final assembly, alignment and testing of the concentrator maintenance crane in the last week of March. No less than 260m2 of factory floor space was set aside for this phase of manufacture.

Transport to site will require three specialised vehicles: two horse-and-dolly movers for the two box-girders, and one flat-bed trailer to be loaded with the hoist, crab, end-carriages, bottom-block, panels and ancillary equipment.

Installation and commissioning at the concentrator will be undertaken by an independent contractor with Condra engineers in support.

Regarding Covid-19, the knock-on effects of the pandemic including lower economic output, job losses and growing poverty, might lead to more demands for social intervention from governments already facing protests over inadequate service provision.

There is also a likelihood of continued popular protests in Nigeria, Côte d’Ivoire and Uganda, as witnessed in 2020.

More robust and sustainable African responses are needed to tackle the continent’s many complex problems. Plans for economic recovery from COVID-19 must be paired with addressing the governance issues that preceded the pandemic.

The Peace and Security Council (PSC) should proactively table issues, while the African unuion (AU) Commission chairperson could mobilise resources such as preventive diplomacy and mediators. AU member states need to adhere to continental norms and instruments such as the African Charter on Democracy, Elections and Governance.

The Democratic Republic of the Congo will chair the AU in 2021 and must contend with these continental issues. This comes as President Félix Tshisekedi tries to consolidate his power domestically. There is little doubt that 2021 will be yet another challenging year for Africa.

Antonio Naranjo, sales and marketing manager, Jaso Industrial Cranes, based in Spain, says the company has more than 350 cranes operating in Africa, mostly in the north of Africa and South Africa as well as the rest of the continent and is currently looking for more distributors.

It recently won contracts with a company which manufactures towers and flanges for the wind energy sector, and another contract for a solar thermal power plant in South Africa. However it declined to name the companies due to confidentiality.

In terms of wind power, The South African Wind Energy Association (SAWEA) has opened registration for WINDABA 2021, with the theme, ‘Renaissance of the Wind Energy Industry – Delivering Economic Benefits for SA’, scheduled to take place from October 7-8. Now in its 10th consecutive year, the event is supported by the Global Wind Energy Council (GWEC).

“Last year we saw the Ministerial determination for procurement of renewables and other energy technologies being issued, promptly followed by the long-awaited Bid Window 5, which was issued in March, after a seven year internal period. So it is indeed a new season for the sector and the opportunity to deliver on the much anticipated economic benefits for the South African economy,” said Ntombifuthi Ntuli, CEO, SAWEA.

“Today we have a solid and mature industry that is ready to build an additional 14.4GW of wind power capacity over the next decade,” added Ntuli.

In terms of business, Jaso says it is still active in the region. “Our main clients in Europe have facilities in Africa so we can assemble our cranes in this part of the world and we work with our distributors to stay in touch with local companies,” says Naranjo. “The main challenge for us is the Covid pandemic and being able to move freely without restrictions. Our goal is to find more distributors on the continent to have a greater presence in Africa.”