Crane companies looking for the next area of growth are quickly turning their attention eastwards towards Indonesia.

All for good reason. Fixed investment in Indonesia has soared over the past decade, with its share of total GDP rising from 19.5% in 2003 to a high of 33.2% in 2012. The construction industry has been a clear beneficiary of this investment. According to the latest figures, construction has grown by 7.4% on an annual average basis, in real terms, over the past 10 years, well above the GDP growth rate of 5.9%.

Despite earlier fears that Asia’s most dynamic economy may have peaked following the post-2008 resurgence, Indonesia has maintained it’s rate of growth in 2012, expanding by 7.5%. In line with this trend, the construction sector’s share of total GDP increased from 6.2% in 2003 to 10.4% in 2012.

Despite some challenges, the outlook for construction is favorable, supported by urbanization, rising incomes and government efforts to improve the infrastructure base as a part of its ambitious multiyear Master Plan for the Acceleration and Expansion of Indonesia’s Economic Development (MP3EI). According to global management consultant company, the McKinsey Global Institute, by 2030, the country could have the world’s 7thlargest economy, overtaking Germany and the United Kingdom.

However, a revealing report by World Market Intelligence’s (WMI is the publisher of OCH Magazine) Construction Intelligence Centre (CIC) called Construction Equipment in Indonesia: A Market Appraisal, warns of distant storm clouds that could dampen the country’s accelerated growth plans.

In particular, economic analysts concede that Indonesia’s infrastructure is largely underdeveloped and in need of massive investment. Although the government has set an ambitious plan to address this issue, the required improvements to transport links, energy and communications will take time.

The Construction Equipment in Indonesia: A Market Appraisal report also warns that the ever-present spectre of corruption in government circles continues to present a major impediment to growth and is "an additional cost burden that deters investment spending."

Speaking during the recent publication of an anti-corruption white paper entitled "Anti-Corruption in Indonesia" Corene Crossin, Control Risks’ managing director for Southeast Asia, said bluntly: ""It is clear that corruption is — and will continue to be — pervasive in Indonesia."

In fact corruption is considered such a serious hindrance to Indonesia’s development that, in 2004, the country’s electorate voted President Yudhoyono (pictured) into power largely on his promises to fight graft and corruption. That message has continued during his second term. Yet, corruption remains a serious problem and, overall, progress has been slow.

According to many observers, one reason for the moderate pace of reform on corruption issues is Indonesia’s deeply embedded institutional culture of patronage.

Often, acts of bribery or corruption are simply not viewed by Indonesian authorities as corrupt practices.

Increasing the training and knowledge of the types of activities that constitute corruption is therefore key in changing these attitudes. A second challenge to combating corruption is that Indonesia’s oversight mechanisms are largely under-resourced.

Many agencies lack the capacity and advanced skills required to deal with complex cases of corruption and abuses of public expenditure, particularly in investigation, surveillance and interview techniques. However, despite these concerns, there is no denying Indonesia’s huge potential for growth, not only in exploiting its vast reserves of national resources, but also in construction, particularly in developing the country’s infrastructure.

The CIC report notes: "The economy bounced back strongly after the disastrous impact of the Asian financial crisis in the late 1990s, during which the economy shrank by 13% in real terms. Over the past 10 years Indonesia’s real GDP has expanded at an annual average rate of 5.7%, an impressive pace that only lags behind its Asia peers of China and India.

"During this 10-year period, Indonesia’s nominal GDP increased from USD235 billion to USD1.1 trillion, and per capita GDP soared from around USD880 to USD3,600."

Construction Equipment in Indonesia: A Market Appraisal attributes the rapid growth in the past decade largely to the expansion in investment and private consumption.

Gross fixed capital formation has registered average annual growth of 8% over the past 10 years, while private consumption rose by 6.5% a year on average during the same period.

It is mainly owing to the fact that Indonesia has a relatively large domestic economy and a lower reliance on external trade than its South-East Asian counterparts that it managed to continue posting healthy growth in 2009, while others such as Thailand and Malaysia experienced economic recessions amid the worst of the global financial crisis.

For crane companies looking to develop business in south-east Asia, the CIC reports that Indonesia’s construction sector has been performing well in recent years driven by strong economic activity and high levels of investment.

Indeed, the report says, "fixed investment has soared over the past decade, with its share of total GDP rising from 19.5% in 2003 to a historic high of 33.2% in 2012." Construction Equipment in Indonesia: A Market Appraisal adds: "The construction sector has been a clear beneficiary of this investment activity. It has grown by 7.4% on an average basis in real terms over the past 10 years, well above the GDP growth rate of 5.9%. It maintained this rate of growth in 2012, expanding by 7.5%. In line with this trend, the construction sector’s share of total GDP increased from 6.2% in 2003 to 10.4% in 2012."

Despite some challenges, the outlook for construction is favorable. In nominal output value terms, the sector will grow by 15% a year in the next five years, supported by urbanization, rising incomes and the government’s effort to improve the infrastructure base as part of its ambitious multiyear plan — the Master Plan for the Acceleration and Expansion of Indonesia’s Economic Development (MP3EI). In order to attract investment for the master plan, which envisages spending of up to IDR4,000 trillion (around USD400 billion) during the 2011- 2025 timeframe, the government is taking steps to strengthen public-private partnership (PPP) regulations.

Infrastructure construction will be the leading sector in terms of growth, but the other construction sectors will also see healthy growth given the positive economic outlook and the rapid expansion of the country’s middle class.

Indonesia has attracted massive foreign direct investment (FDI) in recent years, with the total rising to USD24.6 billion in 2012.

However, the share attracted by the construction sector has been falling, dropping to just USD240 million in 2012 from a recent high of USD618.4million in 2010.

FDI in construction dipped only slightly in 2008, before continuing on an upward trend in the following two years, but the slump in 2011-12 is a concern for the government as it tries to boost investment in infrastructure construction.

Although FDI in the construction sector has disappointed, domestic firms ramped up investment spending in 2012.

According to data from the Indonesia Investment Coordinating Board (BKPM), total domestic direct investment in construction soared to around IDR4.6 trillion (USD470 million) in 2012.

However, this followed two years of weak domestic investment in construction, averaging just IDR666 billion a year.

The government is trying to kick-start rapid development of the country’s infrastructure, the state of which is currently a major drawback for investors. The government has already announced its intention to boost infrastructure construction spending, with proposals to spend IDR194 trillion (USD20 billion) in 2013, up from IDR169 trillion (USD18 billion) in 2012, to finance the construction of a number of major road, railway and airport projects.

In a note to clients dated November 22, international brokerage JP Morgan stated: "The construction sector has contributed around 10% of Indonesia’s GDP since 2009, higher than the average 6-8% in 2001-2007. We believe that the construction sector could benefit from the multi-year trend in the new investment cycle."

The bank cited data from financial information provider CEIC that showed Indonesia’s fixed asset investment to GDP ratio standing at 33% as of March 2012.

Local brokerage SucorInvest shares the upbeat view. In a note to clients dated November 30 2012, it said the strong growth expected in the construction industry "is mainly explained by robust infrastructure projects coupled with lower project delay or cancellation in the current strong economic environment."

The catalysts for stock price boosts in the construction and infrastructure sector were already apparent during 2011.

The good news did not stop there. Two key international rating agencies, Fitch Ratings and Moody’s Investors Service, recently upgraded Indonesia’s rating to investment grade, the first time the country could bask in such a status since 1997.

The rating upgrade provided better bargaining power for construction companies to seek financing from the capital market.

The robust performance of the construction industry in recent years has created great demand for building materials in Indonesia, and supported the expansion in Indonesia’s building materials industries.

According to the Indonesian Cement Association (ASI), cement consumption reached around 55 million tonnes in 2012, up from 48 million tonnes in the previous year.

Much of this is met by domestic production, with state-owned PT Semen Indonesia, the largest cement group in the country (including PT Semen Padang and PR Semen Tonasa), producing 22.6 million tonnes in 2012.

Other key players include PT Indocement Tunggal Prakarsa, in which Germany’s HeidelbergCement Group is a leading shareholder, and PT Holcim Indonesia, part of the Holcim Group.

The heavy equipment industry in Indonesia is highly competitive and concentrated, with four local players backed by global heavyweights accounting for around 96% of total production volume. PT Komatsu Indonesia, a joint venture between Japan’s Komatsu and PT United Tractors, is the largest producer, and offers the largest range of products.

It is followed by PT Caterpillar Indonesia, a joint venture between the US’s Caterpillar Inc and PT Tiara Marga Trakindo; PT Hitachi Construction Machinery Indonesia, a subsidiary of Japan’s Hitachi Construction Machinery; and PT Daya Kobelco Construction Machinery Indonesia, a subsidiary of Japan’s Kobelco Construction Machinery.

Adding to the competitive market, PT Sumitomo SHI Construction Machinery Indonesia, a subsidiary of Japan’s Sumitomo (S.H.I.) Construction Machinery, recently established a presence in Indonesia, commencing operations in late 2011. The company’s factory in Karawang, Jawa Barat, has the capacity to produce 1,000 hydraulic excavators annually. Hitachi and Caterpillar are also expanding their operations in Indonesia. Caterpillar has invested USD150 million in a new mining truck facility in Batam, while Hitachi is increasing annual capacity at its plant in Cibitung, to 5,500 units by March 2014, from 3,300.

Demand for heavy equipment has risen strongly in recent years, driven in part by the sharp rise in the number of construction contracting companies operating in Indonesia in recent years.

According to the National Construction Services Development Board, in 2011 there were a total of 182,800 contractors, up from around 112,000 in 2008. Reflecting this expansion, competition is intense, and margins tend to be relatively low.

However, the vast majority of these companies are classified as being smallsized firms. According to the Indonesian Builders Association (Gapensi), the medium and large firms combined account for around 85% of total construction output value, with the thousands of small contractors competing for the remaining 15%. The number of contractors classified as large rose from 695 to 1,742 between 2008 and 2011, while the number of medium-sized firms increased from around 10,000 to 21,000, and small-sized firms expanding in number from just over 100,000 to 160,000. The number of large foreign contractors has also risen, from 79 in 2008 to around 130 currently. The largest of these foreign operators are Kajima (Japan), China Communications Construction, Daewoo Engineering (Korea), and Leighton Holdings (Australia). Demand for heavy equipment in Indonesia has risen strongly in recent years, fuelled by the expansion in building construction and infrastructure and also the sharp growth in mining. Based on data on production produced by Statistics Indonesia, World Market Intelligence estimates that the total value of construction equipment in Indonesia reached USD3.4 billion in 2012, up from around USD1.5 billion in 2007.

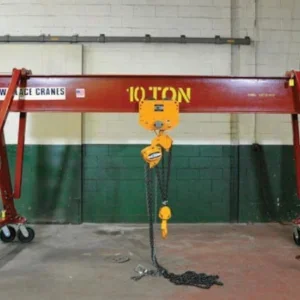

The market value of building construction equipment (broadly comprising concrete equipment and cranes and lifting equipment) is estimated at USD192 million, while for earthmoving and tunnelling equipment the value is estimated to have reached USD1.8 billion In 2012, and mining equipment USD1.1 billion. The robust growth rates of sectors like mining and construction, which is in line with the growth rate of the Indonesian economy, has led to a haloeffect increase in the demand for construction equipment. Over the past decade, heavy equipment demand has come mainly from the mining sector, followed by plantation and construction industries. Heavy equipment demand, which was growing well from 2004 onwards, saw a decline in 2009 due to the global financial crisis.

The demand for construction equipment fell because many construction projects were shelved. However, with a growing optimism among the industry players because of the heavy investment spending in infrastructure as a part of the master economic development plan of Indonesia, the demand for construction equipment began rising and is expected to rise further in the near future.

Indonesia’s robust construction sector continues to be a critical source of employment growth in the country. According to the latest forecasts, around 7 million workers, some 6% of the total labour force, were directly involved in the construction industry in 2012. This was double the number employed a decade or so ago.

However, the role played by the construction sector comes at a cost. The sectors rapid growth and the high demand for construction workers has seen labour costs rise on a steep trajectory. The wages and salary index calculated by Statistics Indonesia show that salaries and wages have increased by 19.3% year-on-year on average in every month since 2009, much above its long-term average of 3.9%, reflecting strong activities in the sector.

CIC says that given the large portion of informal sector workers in construction, changes in actual wages for construction workers are lower than increases in minimum wages. However, it warns, the sharp upward trend in formal sector wages will still put greater pressure on the bottom line.